Navigate memory care Delray FL with our guide. Discover costs, quality, specialized programs & ensure safe, compassionate support.

Memory Care: How Much Does It Really Cost?

Average Memory Care Cost: 2025 Shocking Truth

Understanding the Financial Reality of Memory Care

Average memory care cost varies widely across the United States, but families can expect to pay between $4,000 and $11,000 per month for specialized dementia and Alzheimer’s care. Here’s what you need to know:

| Cost Metric | Amount |

|---|---|

| National Median Cost | $6,450 per month |

| Average Initial Rate | $7,899 per month |

| Annual Cost | $93,420 – $95,000 |

| 2-3 Year Stay (Total) | $190,000 – $285,000 |

| Most Expensive State | Vermont ($10,941/month) |

| Least Expensive State | Wyoming ($4,025/month) |

When a loved one is diagnosed with Alzheimer’s disease or another form of dementia, it’s not just the emotional toll that families face—there’s also the pressing question of how much memory care costs. The numbers can seem overwhelming at first, but understanding what drives these costs and what’s included can help you plan for your family’s future.

Memory care is typically 15-25% more expensive than standard assisted living because it provides specialized staff training, improved security features to prevent wandering, and therapeutic programs designed specifically for individuals with cognitive impairments. While the base rate covers housing, meals, 24-hour supervision, medication management, and memory-enhancing activities, additional fees may apply depending on the level of care needed and the community’s pricing structure.

I’m Jason Setsuda, CFO of Memory Lane Assisted Living and a Board Certified Emergency Medicine Physician with over 15 years of business management experience in senior care. Throughout my career helping families steer the average memory care cost and care options, I’ve seen how proper financial planning can make quality dementia care accessible and provide peace of mind.

Average memory care cost terms explained:

Understanding the Average Memory Care Cost in the U.S.

When researching memory care, one of the first questions is “how much will this cost?” The specialized nature of memory care means it has a higher price tag than other senior living options, but this reflects the comprehensive support your loved one will receive.

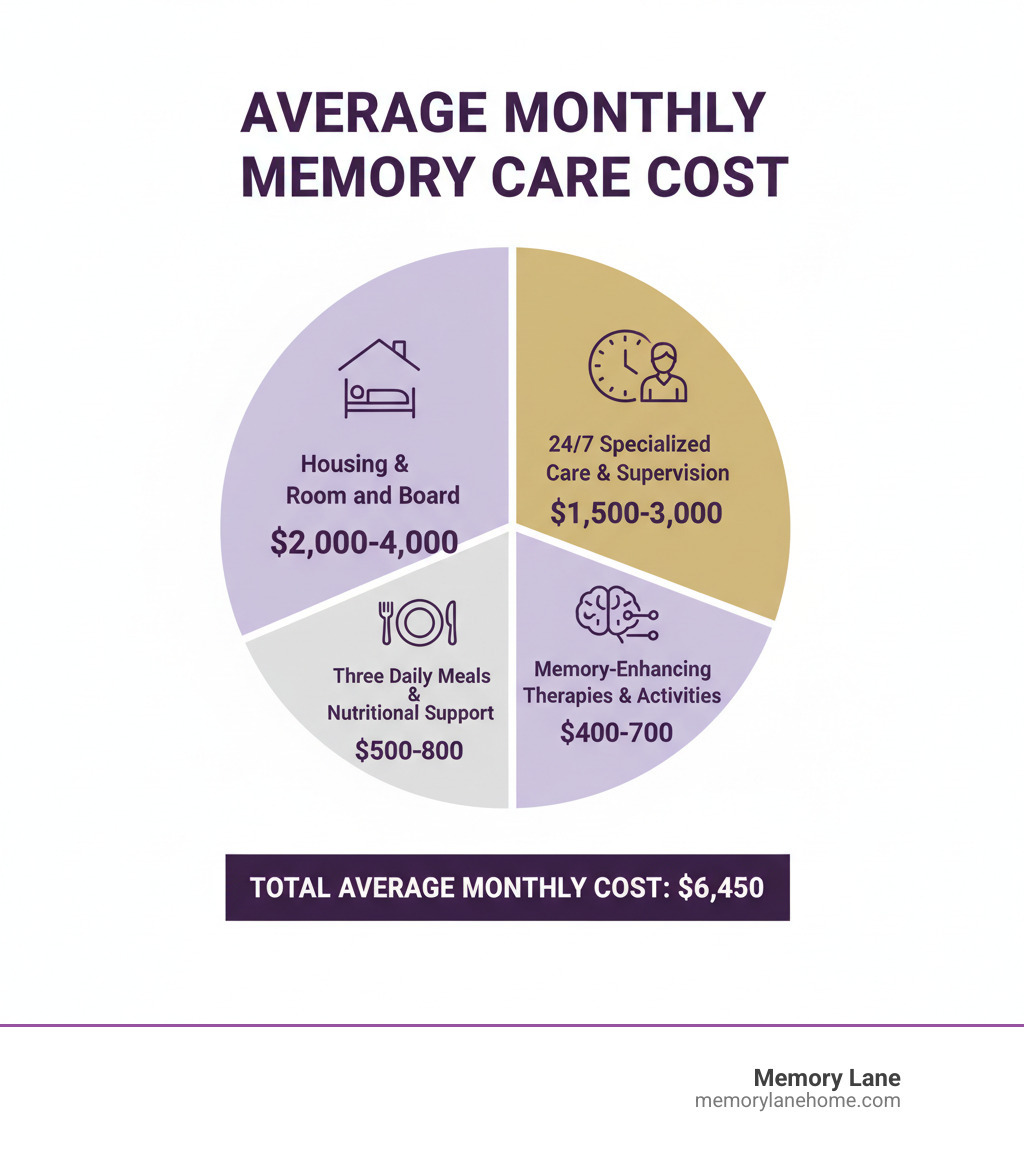

National Average and Median Costs

Various industry reports show that the average memory care cost can seem to be all over the map. This is because different organizations collect data in different ways. For 2025, national median costs are reported between $6,450 and $7,899 per month, which can be nearly $95,000 per year.

The key takeaway is that costs typically range from $4,000 to more than $11,000 per month, depending on your location and the level of care required. The median cost is often a more helpful figure than the average, as it isn’t skewed by a few extremely expensive outliers. Regardless of the exact number, memory care is a significant financial commitment, but it provides specialized support that can’t be replicated at home.

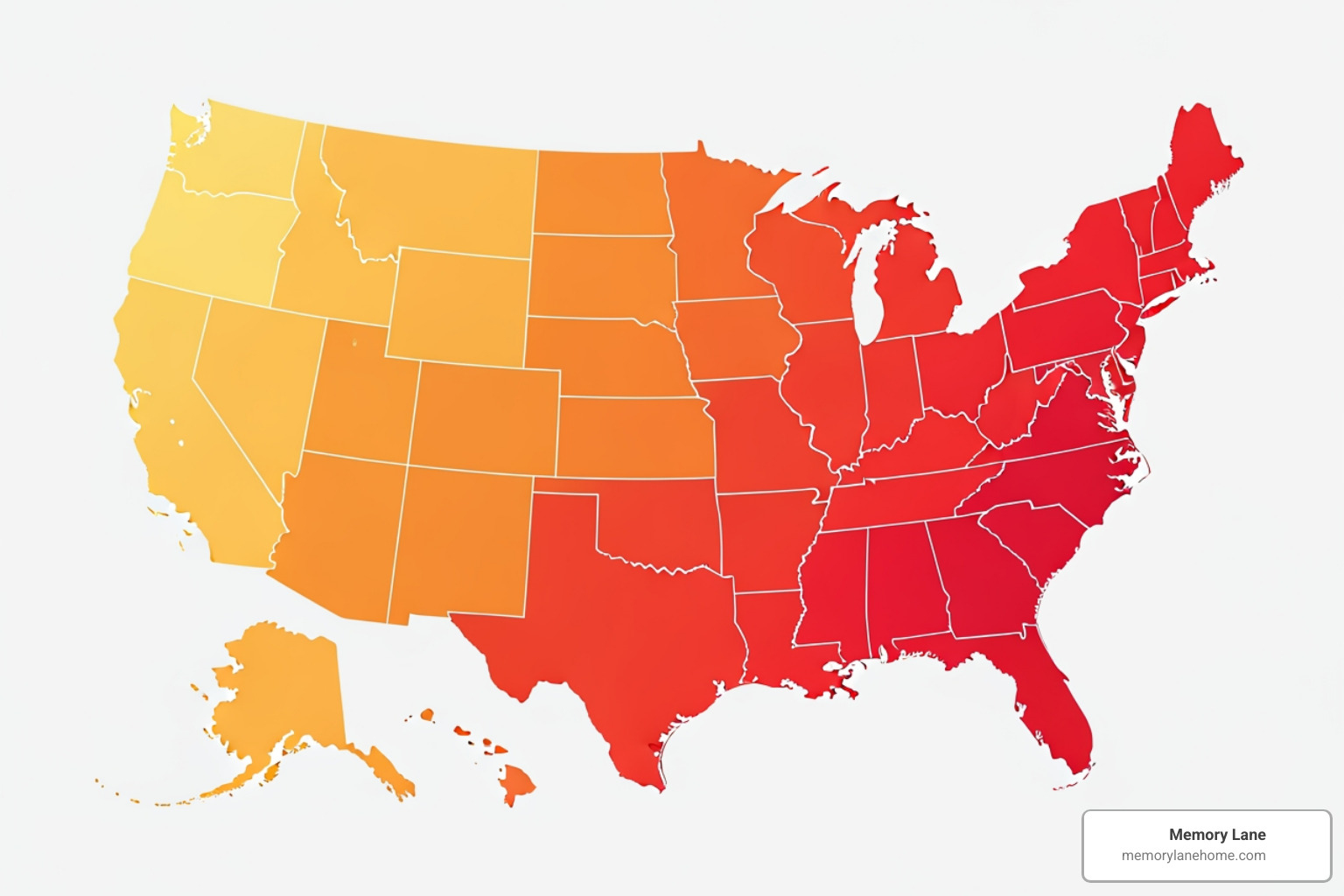

Most and Least Expensive States for Memory Care

Where you live makes a huge difference. For families in Michigan—including Ann Arbor, Ypsilanti, and Saline—it’s helpful to see how our state compares nationally.

At the high end, states like Hawaii ($13,980/month), Alaska ($12,604/month), and Massachusetts ($11,196/month) have the highest costs, often due to a higher overall cost of living.

On the more affordable end, states like South Dakota ($5,377/month), Mississippi ($5,493/month), and Alabama ($5,652/month) offer lower prices.

Michigan sits comfortably in the middle range, with median monthly costs typically between $5,913 and $7,465. This means we’re neither among the most nor the least expensive states. Costs within Michigan can still vary, with metropolitan areas like Ann Arbor and Ypsilanti potentially costing more than smaller towns like Saline due to local real estate values.

How the Average Memory Care Cost Compares to Other Senior Care Options

To understand memory care costs, it’s helpful to compare them to other senior care options. The specialized nature of memory care comes with a higher price, but also with benefits other options can’t provide.

Memory care typically costs 15-25% more than standard assisted living due to its need for more staff, improved security to prevent wandering, and specialized programming. It’s also about twice the cost of independent living.

Here’s how the numbers break down across different care types:

| Care Type | Median Monthly Cost (National Estimates) | Key Services |

|---|---|---|

| Independent Living | $3,145 | Housing, meals, social activities, minimal assistance |

| Assisted Living | $5,190 – $5,350 | Housing, meals, assistance with Activities of Daily Living (ADLs), medication management, social activities, less specialized care |

| Memory Care | $6,450 – $7,785 | Specialized 24/7 supervision, secure environment, custom dementia programs, ADL assistance, medication management, improved staff training |

| In-Home Care | $30 – $33 per hour ($4,957 – $5,148/month for 44 hrs/week) | Personal care, homemaker services, companionship in the comfort of one’s home |

| Nursing Home (Semi-Private) | $8,669 – $104,025 annually ($8,669/month) | 24/7 skilled nursing care, medical supervision, rehabilitation services, ADL assistance |

| Nursing Home (Private) | $9,733 – $116,800 annually ($9,733/month) | 24/7 skilled nursing care, medical supervision, rehabilitation services, ADL assistance in a private room |

Note: Costs are national medians and averages from various 2023-2025 reports and can vary significantly by location and specific needs.

While in-home care might seem less expensive per hour, someone with dementia often needs round-the-clock supervision. Hiring 24/7 in-home care can quickly become more expensive than a memory care community. For families dealing with advanced dementia, memory care often provides better overall value by bundling services, a secure environment, and trained staff into one monthly fee.

What’s Included? A Breakdown of Memory Care Services & Fees

When families see the average memory care cost, they often wonder what they’re paying for. Memory care isn’t just a room and three meals a day; it’s a carefully orchestrated package of specialized services for people living with dementia.

Services & Amenities Covered in the Monthly Fee

The monthly fee in most quality memory care communities is comprehensive. It includes:

- 24/7 Supervision and Care: Constant monitoring by staff specially trained in dementia care.

- Secure Environment: Features like alarmed exits and enclosed outdoor spaces to prevent wandering.

- Personal Care: Assistance with Activities of Daily Living (ADLs) such as bathing, dressing, and grooming.

- Medication Management: Trained staff ensure correct medications are taken on time.

- Dining Services: Three nutritious daily meals, with accommodations for special diets and eating assistance.

- Housekeeping and Laundry: Keeping living spaces clean and comfortable.

- Specialized Activities: Therapeutic programs like art, music, and reminiscence therapy designed to engage residents and support cognitive function.

- Personalized Care Plans: An individualized plan that is regularly reviewed and adjusted as needs change.

- Other Amenities: Services often include scheduled transportation, incontinence care, and emergency call systems.

These bundled services require a higher staff-to-resident ratio and specialized training, which is why memory care costs more than standard assisted living.

Understanding Pricing Models and Extra Fees

Memory care communities use different pricing structures, which can impact your budget.

- All-Inclusive Pricing: One flat monthly rate covers all care and services. This model, used by communities like Memory Lane, offers predictable costs, as your bill won’t increase even if care needs change.

- Tiered Pricing: A base rate covers housing and basic services, with additional fees for higher “levels of care.” Costs increase as a resident’s needs progress.

- A La Carte Pricing: Less common in memory care, this model charges separately for specific services beyond the base rate.

Beyond monthly fees, expect one-time charges like a community fee (median of $3,000) to cover administrative and move-in costs. Also, plan for annual rate increases of 3% to 8% to account for inflation and rising operating expenses. Factoring this into your long-term plan is crucial.

Key Questions to Ask About Costs

When touring communities, ask detailed questions to understand the true average memory care cost for your situation and avoid surprises.

- What is included in the base monthly rate, and what services cost extra?

- If you use tiered pricing, how are care levels assessed and what triggers a move to a higher-cost level?

- What is the community fee, what does it cover, and is any part of it refundable?

- How much have rates increased annually over the past few years?

- Are there any move-in incentives or promotions available?

- What is the policy if a resident’s care needs exceed what the community can provide, or if a family can no longer afford the costs?

- Is there any room to negotiate the cost?

Getting clear answers to these questions is a crucial part of your due diligence.

How to Pay for Memory Care: Exploring Your Financial Options

Once you understand the costs, the next question is, “How will we pay for it?” While it’s a significant investment, there are multiple pathways to make it work financially. Consulting an elder law attorney or financial advisor who specializes in senior care can help you create a strategy.

The Role of Medicare and Medicaid

A common misconception is about government assistance. It’s crucial to know what is and isn’t covered.

Medicare generally does not cover long-term memory care costs. Medicare is for short-term, medically necessary care. It may cover up to 100 days in a skilled nursing facility for rehabilitation after a hospital stay, but it does not pay for ongoing custodial care like that provided in a memory care community. You can find more details on Medicare coverage for dementia care.

Medicaid, however, can be a significant resource for those who meet strict income and asset limits. Many states, including Michigan, have Home and Community Based Services (HCBS) waivers that can help pay for memory care. This may require a “spend-down” of personal assets to qualify. Rules vary by state, so contact your state Medicaid agency for specific eligibility requirements.

Using Insurance, Benefits, and Personal Assets

Several other financial resources can help cover the average memory care cost.

- Long-Term Care Insurance: If your loved one has a policy, review it thoroughly for coverage details, daily limits, and waiting periods. It can be a game-changer for affording care.

- Veterans Benefits: The VA’s Aid and Attendance program provides monthly payments to eligible veterans and surviving spouses to help cover long-term care. Contact the VA at (800) 698-2411 to explore this option.

- Personal Assets: Savings, retirement funds (401(k)s, IRAs), pensions, and investments are common funding sources.

- Home Equity: Selling the family home is a practical approach. Other options include a reverse mortgage or a bridge loan, but be sure to work with a trusted financial advisor to avoid potential scams targeting older homeowners.

- Life Insurance: Some policies can be converted to funding for care. Options include accelerated death benefits or a life settlement, where the policy is sold for cash. You can learn more about using life insurance to pay for long-term care.

How to Potentially Lower the Average Memory Care Cost

Here are some practical strategies that can help reduce the average memory care cost:

- Negotiate Rates: It never hurts to ask if a community has flexibility on pricing.

- Ask About Promotions: Many communities offer move-in specials, such as a waived community fee or a free month’s rent.

- Choose a Shared Room: A semi-private room can significantly reduce monthly costs while providing companionship.

- Explore Tax Deductions: A portion of memory care costs may qualify as a medical expense deduction. Consult a tax professional and see the IRS medical expense deductions page for details.

- Inquire at Non-Profits: Some non-profit communities have financial assistance programs for residents.

- Use Local Resources: Contact your local Area Agency on Aging or use free services like BenefitsCheckUp to find programs you may qualify for.

Frequently Asked Questions about Memory Care Costs

We understand that the financial side of this decision can feel overwhelming, so let’s address some of the most common concerns we hear.

What is the typical duration of a stay and how does it impact the total cost?

The typical stay in a memory care community is between two and three years. This can vary based on when a person moves in and the progression of their dementia.

Multiplying the average memory care cost by this timeframe results in a total estimated expense of $190,000 to $285,000 for a complete stay. This figure underscores the importance of long-term financial planning, ideally starting as soon as a diagnosis is received.

Can children be held responsible for a parent’s memory care costs?

Generally, no, adult children are not responsible for their parent’s memory care costs. A parent’s debt is their own.

However, there are exceptions. You could be held liable if you:

- Sign an admission agreement as a financial guarantor. Always have an elder law attorney review any documents before signing.

- Misappropriate your parent’s funds while acting as their power of attorney.

Some states have “filial responsibility laws,” but they are rarely enforced for long-term care costs. For more on the legal considerations for families, it’s best to consult an attorney.

Are there any one-time fees associated with moving into a memory care community?

Yes, it’s important to budget for upfront costs. The most common is a community fee (or admission fee), which is a one-time, typically non-refundable charge. The national median is $3,000. This fee covers administrative costs, resident assessments, and apartment preparation.

Some communities may also require a refundable security deposit. Always ask for a written breakdown of all one-time fees, what they cover, and which are refundable. Understanding these initial expenses is key to calculating the true average memory care cost for the first month.

Finding the Right, Affordable Care for Your Loved One

We know that navigating memory care costs can feel overwhelming. You’re facing difficult decisions during an already emotional time, trying to balance your desire to provide the best possible care with very real financial concerns. At Memory Lane, we’ve walked alongside hundreds of families through this journey, and we want you to know that finding quality, affordable care for your loved one is possible.

The average memory care cost represents more than just a monthly expense—it’s an investment in your loved one’s safety, dignity, and quality of life. When you choose specialized memory care, you’re providing a secure environment where wandering is prevented, where trained staff understand the unique challenges of dementia, and where daily activities are designed specifically to engage and support individuals with cognitive impairments. This level of care often cannot be safely replicated at home, no matter how much love and dedication family caregivers provide.

At Memory Lane, our person-centered approach means we see your loved one as an individual, not just another resident. We focus on what they can still do, not what they’ve lost. We help them maintain their independence and sense of purpose through meaningful activities and compassionate support. This is what makes memory care worthwhile—the peace of mind knowing your loved one is safe, engaged, and cared for by professionals who truly understand dementia.

For families in Ann Arbor, Ypsilanti, and Saline, Michigan, we encourage you to visit us and see how our specialized care can make a difference. Ask all the questions we’ve outlined in this guide. Review the services included in the monthly fee. Talk to our staff and, if possible, speak with other families who have loved ones in our care. Compare the value of what you’re receiving, not just the bottom-line cost.

Financial planning for memory care takes time and careful consideration. Start the conversation early if you can. Explore all your payment options, from long-term care insurance to veterans benefits to Medicaid waivers. Work with an elder law attorney or financial advisor who specializes in senior care planning. And remember, we’re here to help you through this process.

To learn more about our dementia care services and how we can support your family during this transition, please visit our dedicated page: Learn more about our dementia care services. We’re ready to answer your questions and help you find the right care solution for your loved one.